If you are struggling to afford food for yourself and your household, you should consider applying for food stamps. Food stamps are monthly cash benefits that can be used to purchase eligible food items at the grocery store.

One of the first questions food stamps applicants want to know is how the food stamps calculator works. That’s because it will tell you how much you’re expected to receive in food stamps if your application is approved.

That’s an important question because they want to know if the amount of benefits is going to make a difference.

In this article, we will walk you through how to calculate your benefit amounts, based on your household income and other important eligibility criteria. At the end of the article, you will be able to determine how much you will receive in food stamp benefits if you are eligible.

How much in Food Stamps you receive essentially boils down to your household income and the number of allowable deductions you have. First, let’s review the eligibility criteria.

Food Stamps Eligibility for 2024

Under federal rules, to be eligible for food stamps benefits, a household’s income and resources must meet three tests:

Gross Monthly Income

This is a household’s income before any allowable deductions are applied. This income must be at or below 130 percent of the poverty line.

In fiscal year 2024, the poverty line amount for an individual is $1,215. Therefore for food stamps application, 130 percent of that level is $1,580. An individual applying for food stamps must, therefore, have a gross monthly income of $1,580 or below to qualify.

For a family of three, the poverty line is $2,072 a month. Therefore, 130 percent of that is $2,694 a month, or about $32,328 a year. The poverty level is higher for bigger families and lower for smaller families.

Net Income

This is a household’s income after allowable deductions are taken out. The resulting amount must be at or below the poverty line.

Food Stamps Allowable Deductions

Certain deductions are allowed to be taken from the gross income to arrive at the net income amount.

The following deductions are allowed for all households depending on the living situation and expenses:

- 20 percent deduction from earned income to account for work-related expenses and payroll taxes.

- A standard deduction based on household size (see below) to account for basic unavoidable costs.

- Dependent care deduction for out-of-pocket child care or when needed for work, training, or education.

- Child support deduction for any legally obligated child support that a member of the household pays.

- Medical expense deduction for elderly or disabled household members that have incurred out-of-pocket medical expenses greater than $35 a month.

- Homeless household shelter deduction of $179.66.

- Excess shelter deduction for households with a shelter cost that exceed more than half of the household’s income. This deduction is uncapped for households with an elderly or disabled member. However, for all other households, this deduction is capped at $672 per month.

Once you have subtracted all eligible deductions from your household gross income, this will give you your monthly net income.

SNAP Standard Deduction

The food stamps standard deduction varies based on your household size and location. Please use the chart provided below to find the standard deduction amount for your household.

| SNAP Standard Deductions for Fiscal Year 2024 | |||||

| Effective October 1, 2023 – September 30, 2024 | |||||

| Household Size | SNAP Standard Deduction | ||||

| 48 States & D.C. | Alaska | Guam | Hawaii | Virgin Islands | |

| 1-2 | $198 | $338 | $397 | $279 | $174 |

| 3 | $198 | $338 | $397 | $279 | $174 |

| 4 | $208 | $338 | $416 | $279 | $208 |

| 5 | $244 | $338 | $487 | $280 | $244 |

| 6+ | $279 | $349 | $558 | $321 | $270 |

To learn more about how to calculate your household’s Net Income, read our complete Food Stamps eligibility article.

What counts as income for Food Stamps Application?

For those applying for food stamps, it is important to know what the government counts as income.

Generally, the USDA counts cash income from all sources, including earned income (before payroll taxes are deducted) and unearned income, such as cash assistance, Social Security, unemployment insurance, and child support.

Assets & Resources

The assets (such as cash or money in a bank account) belonging to the household must fall below certain limits. If your household does not have a member that is disabled or elderly (age 60 and older), then your total assets must equal $2,750 or less.

For households with a member who is elderly (age 60 or older) or disabled, your total assets and countable resources must equal $4,250 or less.

However, certain resources are NOT counted when determining eligibility for food stamp benefits:

- A home and property/lot

- Resources of people who receive Supplemental Security Income (SSI)

- Resources of people who receive Temporary Assistance for Needy Families (TANF/welfare)

- Most retirement and pension plans (withdrawals from these may count as income or resources depending on frequency)

What counts as an Asset for Food Stamps Application?

The USDA counts assets and resources as any item that could be available to the household to purchase food, such as money in a bank account.

This includes:

- Bank accounts

- Stocks

- Bonds

- Real estate other than your home

- Income you earn from assets (like interest earned on savings and dividends you receive)

Items that are not accessible are not considered a countable resource or asset. This can include the household’s home, personal property, retirement savings and pension plans.

Please note that retirement savings and pension plans may count as income or resources depending on how often they occur.

Therefore, we recommend consulting your state specific guidelines to know what will be counted as assets during your food stamps application.

To get in contact with your state’s food stamps agency, click here.

In addition, the resources of people who receive additional government assistance do not count towards your total resource limit.

This includes income from:

- Supplemental Security Income (SSI)

- Temporary Assistance to Needy Families (TANF)

Do vehicles count as an asset for SNAP?

While most vehicles do not count towards the food stamps resources limit, this varies based on the state you live in.

Your state directly determines how vehicles may count towards the household resource limit.

Licensed vehicles are NOT counted if they are:

- Used for income-producing purposes (e.g., taxi, truck or delivery vehicle)

- Annually producing income consistent with their fair market value

- Needed for long distance travel for work (other than daily commute)

- Used as the home

- Needed to transport a physically disabled household member

- Needed to carry most of the household’s fuel or water

- If the sale of the vehicle would result in less than $1,500.

For non-excluded licensed vehicles with a fair market value over $4,650, they will count as a resource.

In addition, licensed vehicles are also subject to an equity test, which is the fair market value less any amount owed on the vehicle.

The following vehicles are excluded from the equity test:

- One vehicle per adult household member.

- Any other vehicle used by a household member under 18 to drive to work, school, job training, or to look for work.

- For vehicles with both a fair market value over $4,650 and an equity value, the greater of the two amounts is counted as a resource.

Additionally, the equity value of unlicensed vehicles generally counts as a resource, with some exceptions.

Food Stamps Income Limit for 2024

Most households applying for food stamps must meet the income limit, unless members are receiving TANF, SSI, or some other form of cash assistance from the federal government or state.

There are two parts to the income limit – the gross income and net income. The net income is determined after allowable deductions are taken from the gross income.

Most households must meet both the gross and net income tests unless there is an elderly person or a person who is receiving certain types of disability payments.

It is important to note that if your household income is above the limits shown below, you will not be approved for food assistance.

| SNAP Income Eligibility Standards for Fiscal Year 2024 (48 States, DC, Guam & Virgin Islands) | |||

| Effective October 1, 2023 – September 30, 2024 | |||

| Household Size | Monthly Net Income (100% of FPL) |

Monthly Gross Income (130% of FPL) |

Monthly Gross Income for Elderly/Disabled Households (165% of FPL) |

| 1 | $1,215 | $1,580 | $2,005 |

| 2 | $1,644 | $2,137 | $2,712 |

| 3 | $2,072 | $2,694 | $3,419 |

| 4 | $2,500 | $3,250 | $4,125 |

| 5 | $2,929 | $3,807 | $4,832 |

| 6 | $3,357 | $4,364 | $5,539 |

| 7 | $3,785 | $4,921 | $6,246 |

| 8 | $4,214 | $5,478 | $6,951 |

| Each Additional Household Member: | +$429 | +$557 | +$707 |

As you can see, both the gross and net monthly income calculations are based on the number of people in your household. The income limit rises as you add additional members to your household.

Here are the deductions that are allowed to arrive at your net monthly income number:

- 20 percent deduction from earned income to account for work-related expenses and payroll taxes.

- A standard deduction based on household size (see below) to account for basic unavoidable costs.

- Dependent care deduction for out-of-pocket child care or when needed for work, training, or education.

- Child support deduction for any legally obligated child support that a member of the household pays.

- Medical expense deduction for elderly or disabled household members that have incurred out-of-pocket medical expenses greater than $35 a month.

- Homeless household shelter deduction of $179.66.

- Excess shelter deduction for households with a shelter cost that exceed more than half of the household’s income. This deduction is uncapped for households with an elderly or disabled member. However, for all other households, this deduction is capped at $672 per month.

Calculate your Gross & Net Monthly Income

Now that you know the income limits and the allowed deductions, you are now ready to calculate your gross and net monthly income.

The charts below shows you an example of how to calculate both net income and gross income for your household:

| How to Calculate SNAP Gross Income | |

| Gross Income Calculation: | Example: |

| Determine household size . . . | 4 people with no elderly or disabled members. |

| Add gross monthly income . . . |

$1,700 earned income + $750 social security = $2,450 gross income.

|

| If gross monthly income is less than the limit for household size, determine net income. |

$2,450 is less than the $3,250 allowed for a 4-person household, so determine net income.

|

Once you have your gross income limit, now calculate your net income limit to determine if your household is eligible for food stamp benefits.

| How to Calculate SNAP Net Income | |

| Net Income Calculation: | Example for a 4-person household: |

| Subtract 20% earned income deduction… |

$2,450 gross income

$1,700 earned income x 20% = $340. $2,450 – $340 = $2,110 |

| Subtract standard deduction… |

$2,110 – $208 standard deduction for a 4-person household = $1,902

|

| Subtract dependent care deduction… | $1,902 – $362 dependent care = $1,540 |

| Subtract child support deduction… | $0 |

| Subtract medical costs over $35 for elderly and disabled… | $0 |

| Excess shelter deduction… | See below |

| Determine half of adjusted income… | $1,540 adjusted income/2 = $770 |

| Determine if shelter costs are more than half of adjusted income… |

$900 total shelter – $770 (half of income) = $130 excess shelter cost

|

| Subtract excess amount, but not more than the limit, from adjusted income… | $1,540 – $130 = $1,410 net monthly income |

| Apply the net income test… |

Since $1,410 is less than $2,500 allowed for a 4-person household, this household has met the income test.

|

Food Stamps Calculator for 2024

You can use the food stamps calculator to calculate how much you will receive in food stamps benefits.

To begin, we first have to look at the maximum benefit a household could get.

This is amount is set each year and by the United States Department of Agriculture.

For fiscal year 2024, here are the maximum monthly benefits for your household size.

| Maximum SNAP Benefit Amount by Household Size for Fiscal Year 2024 | |

| Effective October 1, 2023 – September 30, 2024 | |

| Household Size | Maximum SNAP Benefit Allotment |

| 1 | $291 |

| 2 | $535 |

| 3 | $766 |

| 4 | $973 |

| 5 | $1,155 |

| 6 | $1,386 |

| 7 | $1,532 |

| 8 | $1,751 |

| Each Additional Household Member: Add | $219 |

The table below from the Center on Budget and Policy Priorities (CBPP) shows you the maximum benefit amount and estimated average benefit amount for the household size.

| Maximum & Average SNAP Benefit Amount by Household Size for Fiscal Year 2024 | ||

| Effective October 1, 2023 – September 30, 2024 | ||

| Household Size | Maximum SNAP Benefit Allotment |

Estimated Average Monthly SNAP Benefit Amount

|

| 1 | $291 | $195 |

| 2 | $535 | $359 |

| 3 | $766 | $577 |

| 4 | $973 | $684 |

| 5 | $1,155 | $818 |

| 6 | $1,386 | $1,011 |

| 7 | $1,532 | $1,048 |

| 8 | $1,751 | $1,150 |

| Each Additional Household Member: Add | $219 | |

As you can see, for a household of one, the maximum food stamps benefit per month $291.

However, the average is $195, which translates to an average of $6.50 a day.

For a family of four, the maximum benefits that can be received is $973.

However, the average benefit amount for a family of four is $684 per month.

This averages $22.80 a day to purchase food for a family of four.

How Much Will I Receive in Food Stamps?

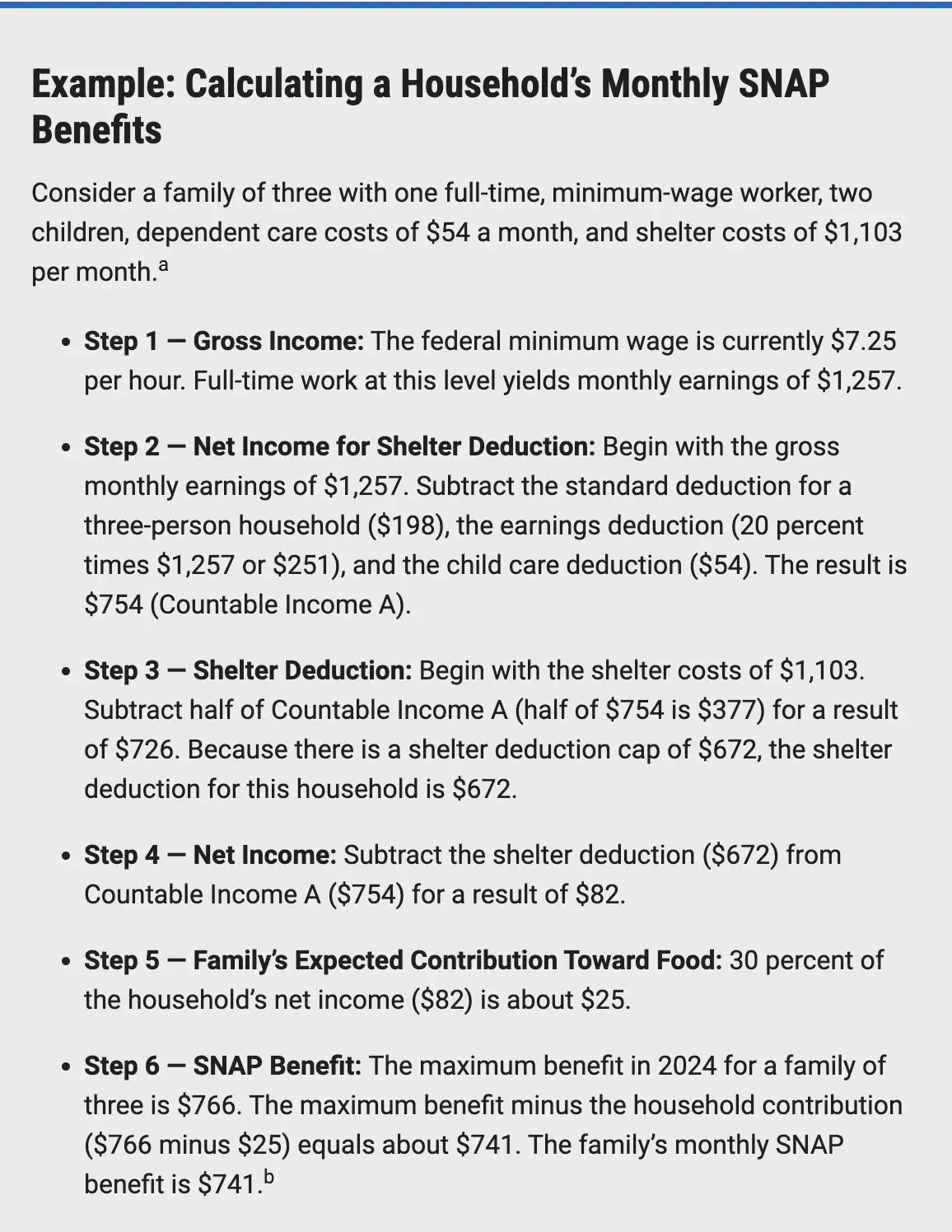

To calculate how much you are can receive in food stamp benefits, we have provided an example below.

This example from the Center on Budget and Policy Priorities (CBPP) will show you how much a family of three is expected to receive.

The family shown includes one full-time, minimum-wage worker, two children, dependent care costs of $67 a month, and shelter costs of $927 per month.

We hope the example provided below will help you calculate your own benefit amount.

Apply for Food Stamps in 2024

If you qualify for benefits, we can help you apply for food stamps. We have provided detailed application instructions by state.

Click here to find specific information for your state.

Food Stamps Eligibility Questions

We hope this article on the Food Stamps Calculator for 2024 was helpful to you!

If you found this article helpful, we encourage you to share it with someone who needs help determining their SNAP eligibility.

If you have additional questions about how to calculate how much you will get in SNAP benefits or how to qualify for food stamp benefits in your state, please let us know in the comments section below.

We are happy to help answer any additional questions you have.

In the meantime, check out our other articles on food stamps eligibility and SNAP:

Food Stamps Income Limit for 2023-2024

Food Stamps Eligibility Guide for 2024

Apply for Food Stamps in your State

Food Stamps Increase for 2024

Extra Food Stamps for 2024